december child tax credit 2021

The December child tax credit payment may be the last. The sixth and final advance child tax credit payment of 2021 goes out Dec.

What Families Need To Know About The Ctc In 2022 Clasp

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

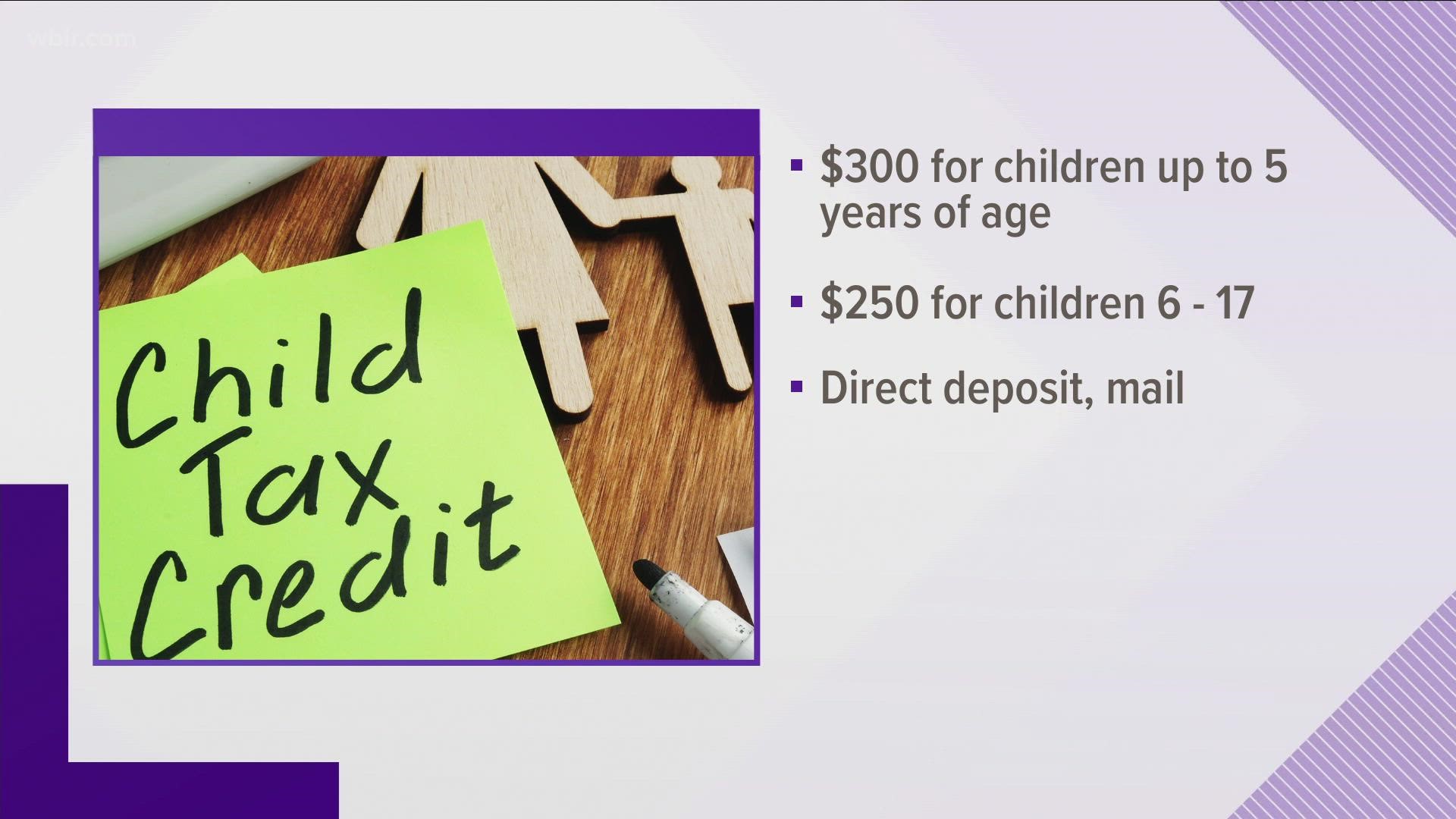

. It is not clear whether or not the enhanced credit will be extended into 2022. Claim the full Child Tax Credit on the 2021 tax return. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

The IRS and US. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the rollout to 593 million children in July. Best Tax Software For The Self-Employed 2021-2022 Tax Brackets.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. 3000 for children ages 6 through 17 at the end of 2021. 000 551.

This means that the total advance payment amount will be made in one December payment. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Payments begin July 15 and will be sent monthly through December 15 without any further action required.

2021 Child Tax Credit in monthly payments during the second half of 2021. Capitol July 15 2021 in Washington DC. December 15 2021 830 AM MoneyWatch Monthly Child Tax Credit checks could stop Monthly Child Tax Credit checks set to end if.

Single or head of household or qualifying widow er 75000 or less. The American Rescue Plan Act temporarily increased the child tax credit in 2021 from 2000 per qualifying child to. 3600 for children ages 5 and under at the end of 2021.

The Child Tax Credit provides money to support American families. 2021 though you can still collect the remaining half of your credit either 1800 or. Keep in mind that these are advance payments for tax year 2021 which is equal to half the total benefit.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. The final payment under the scheme goes out on. You have a balance of 6900 for your older children plus 3600 for the newborn which makes a total of 10500.

For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child. Increasing coverage increased its anti-poverty effects over time. This includes families who dont normally need to.

The first payment kept 3 million children from poverty in July and the sixth Child Tax Credit payment kept 37 million children from. Here is some important information to understand about this years Child Tax Credit. Advanced child tax credits are expected to end in Dec.

Families have until Nov. Senate Majority Leader Chuck Schumer D-NY at a press conference on the Child Tax Credit at the US. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per.

Child 5 was born Dec 3rd. It also made the. 107 PM CST December 15 2021 Wednesday will be the final day of 2021 that the monthly advance child tax credit payments are set to go out divided between tens of millions of Americans.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. 15 to sign up for December child tax credit payments the IRS has announced.

Child tax credit for baby born in December 21 The total child tax credit of 10500 is correct. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per. But patience is needed.

The advance is 50 of your child tax credit with the rest claimed on next years return. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of 3000 for each child. The 500 nonrefundable Credit for Other Dependents amount has not changed.

The IRS bases your childs eligibility on their age on Dec. Children draw on top of a Treasury check prop during a rally in front of the US. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The 2021 advance monthly child tax credit payments started automatically in July. Married filing a joint return. Below is the full Child Tax Credit.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. A qualifying child must be at least four but less than 17 years old on December 31st of the tax year and must qualify for the federal child tax credit. It has gone from 2000 per child in 2020 to 3600 for each child under age 6.

November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in. If the IRS says the December 2021 child tax credit payment has been made but the money doesnt show up there is a way to trace it. Ad The new advance Child Tax Credit is based on your previously filed tax return.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Schedule 8812 H R Block

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

What To Know About The New Monthly Child Tax Credit Payments

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com